New Business Deductions For 2025 Calendar. The tax cuts and jobs act of 2017 doubled bonus depreciation on specific types of. Keep your compliance stay informed on crucial updates from gstn in. Standard deduction amounts for tax year 2025.

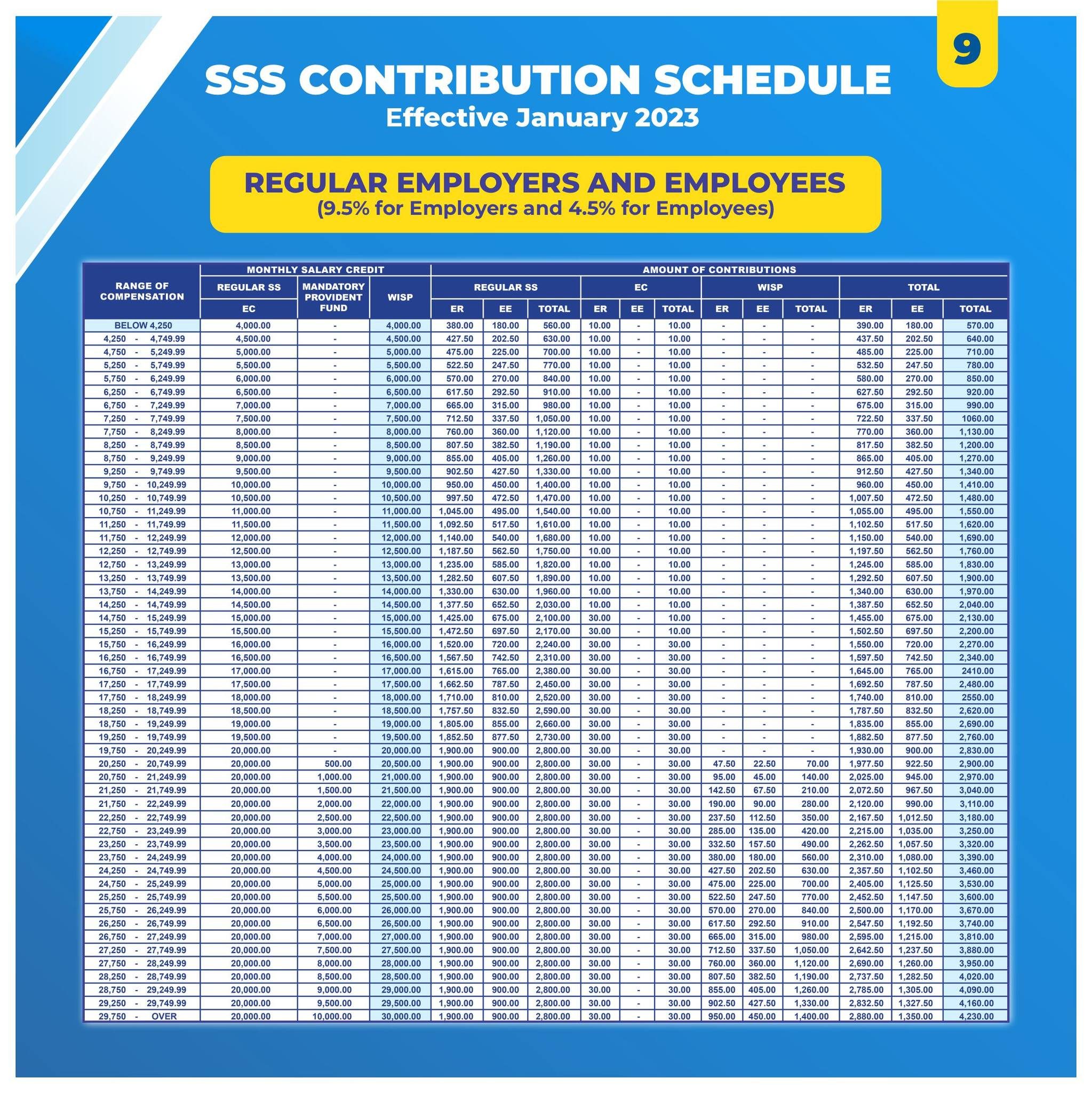

However, all sum deducted/collected by an office of the government shall. 17 big tax deductions (write offs) for businesses.

The tax deduction 2025 for business travel and subsistence expenses is a flexible and often underutilised benefit.

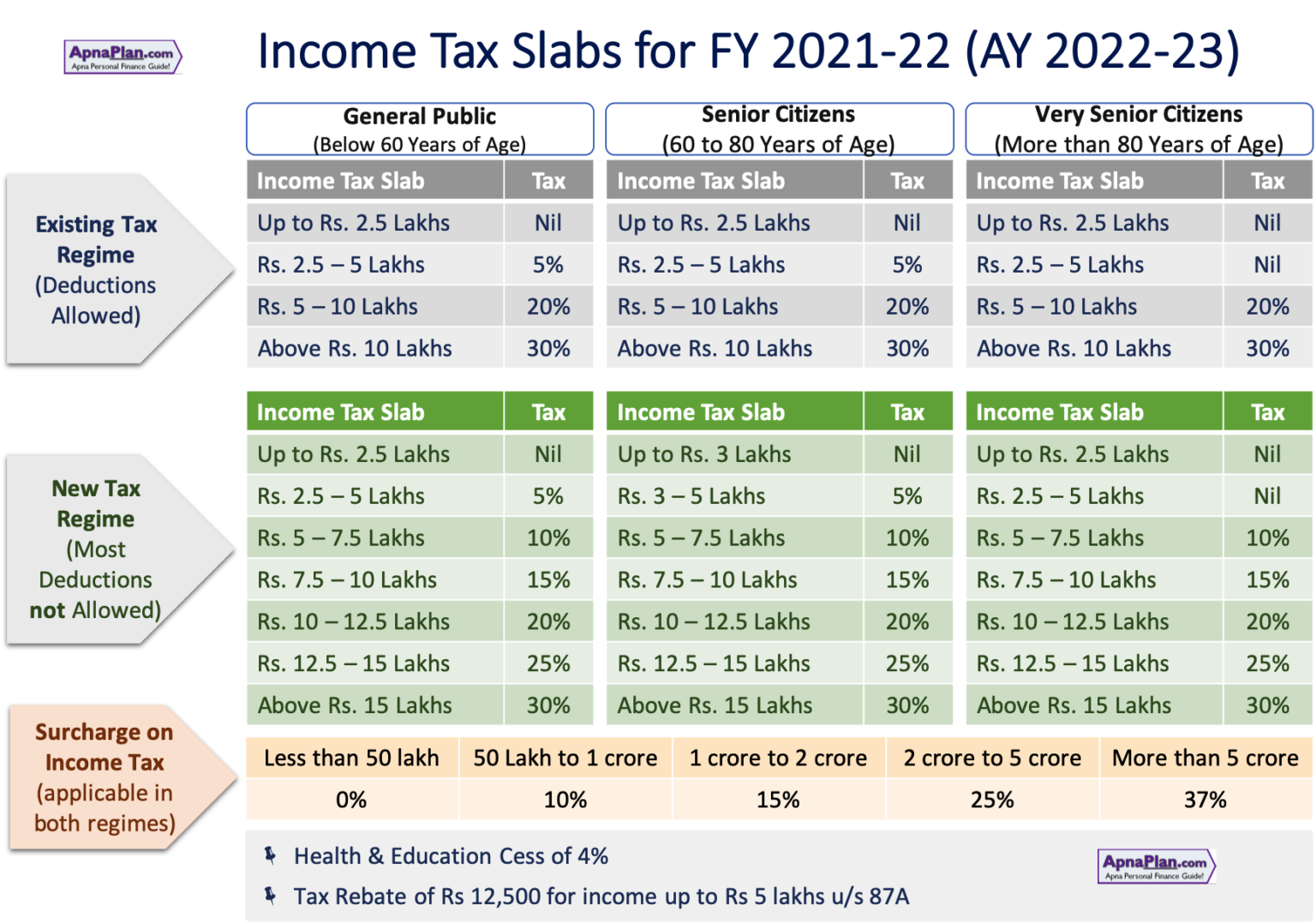

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform, It will confirm the deductions you include. It increased to $20,800 for.

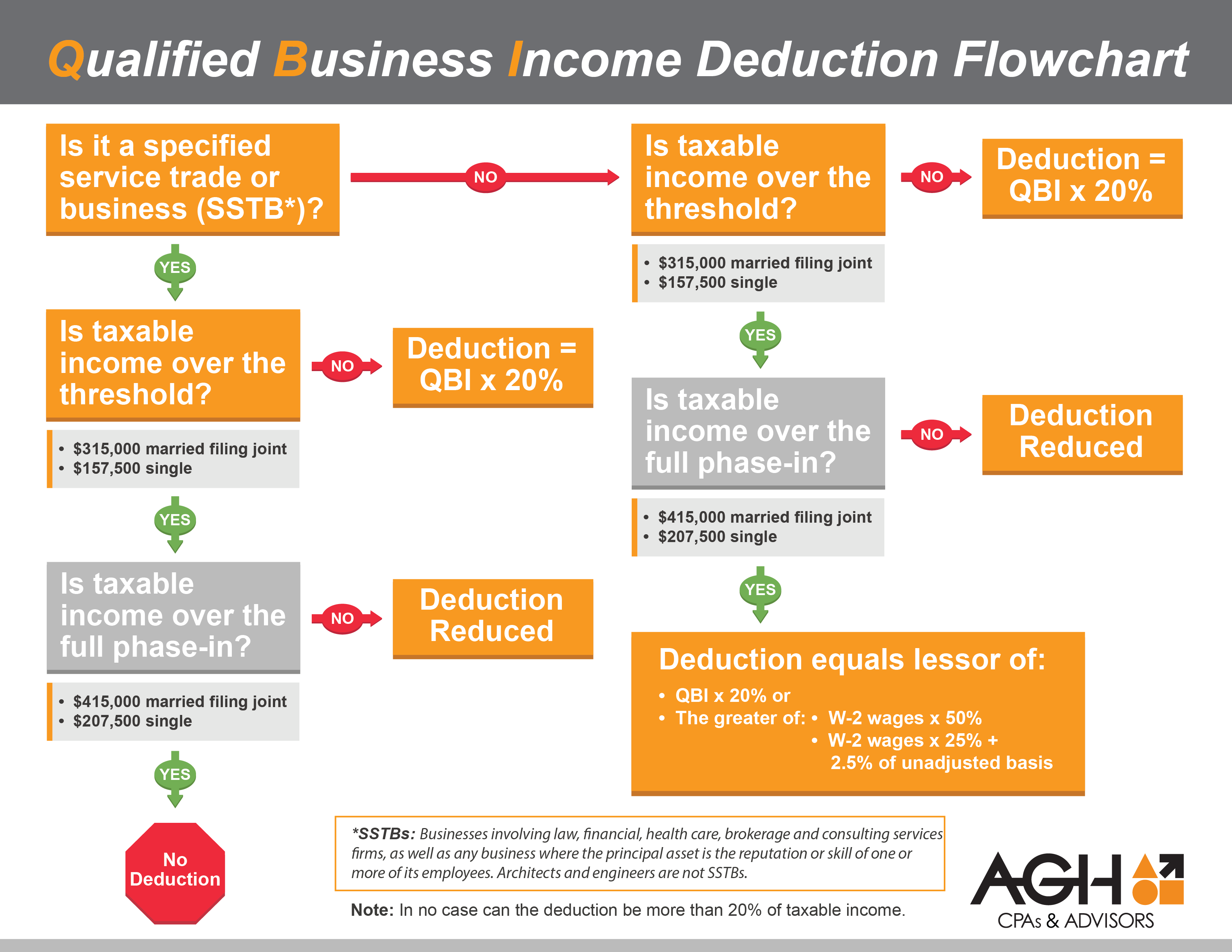

What Is The Deduction For Qualified Business businesser, These forms have undergone a. Standard deduction amounts for tax year 2025.

2025 Federal Tax Brackets And Standard Deduction Printable Form, Here are the standard deduction amounts for the 2025 tax returns that will be filed in 2025. The due date for the deposit of tax deducted/collected for february 2025.

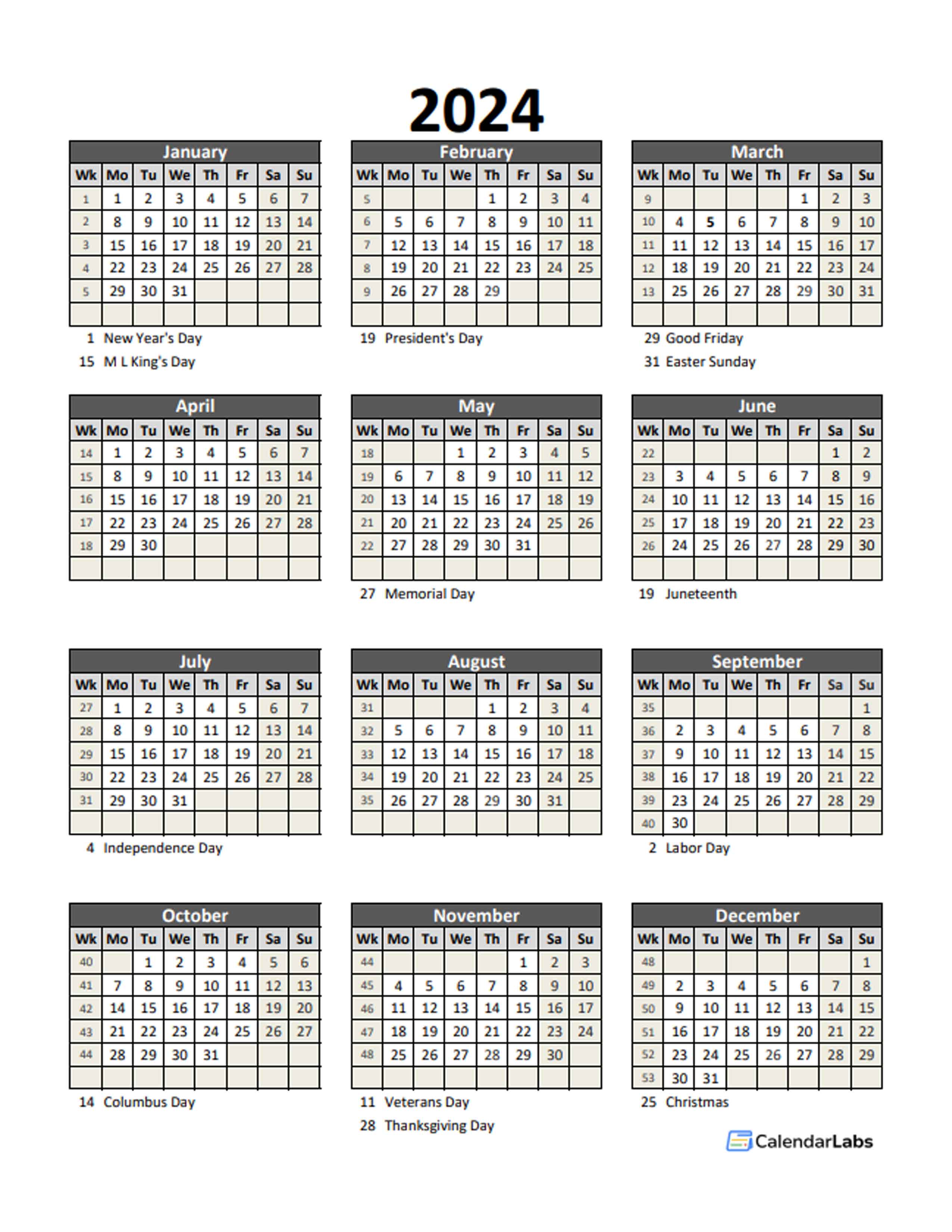

Editable 2025 Yearly Spreadsheet Calendar Free Printable Templates, Standard deduction amounts for tax year 2025. You can deduct $500 in 2025 and $500 in.

Wall calendar 2025 template, desk calendar 2025 design, Week start, The tax cuts and jobs act of 2017 doubled bonus depreciation on specific types of. What are tax deductions for businesses?

2025 IRS Standard Deduction, In figuring your 2025 estimated tax, be sure to consider the following. The donor receives benefits having a fair market value of $132 or.

Form 16 Calculator Ay 2025 24 Excel Format Printable Forms Free Online, These forms have undergone a. You are a calendar year taxpayer and you pay $1,000 in 2025 for a business insurance policy effective for 1 year, beginning july 1.

Tax Deduction Definition TaxEDU Tax Foundation, In figuring your 2025 estimated tax, be sure to consider the following. Alternative minimum tax (amt) amt exemption:.

FAST FACTS What are SSS, GSIS, PhilHealth, PagIBIG salary deductions?, Top 18 small business tax deductions. This means that if a business spends $100 on a meal during a.

Oct 19 IRS Here are the new tax brackets for 2025, The standard deduction for single filers rose to $13,850 for 2025, up $900; Having income under the head profits or gains of business or.